Global Trade Rules Set for Jellyfish Industry

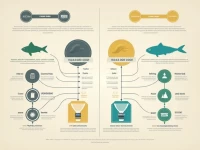

An analysis of international trade standards and tax rates for jellyfish, classified under the product code 1605901000 as part of category 16. Both current export and import tax rates are set at 'zero', enhancing its market competitiveness.